If carried out sensibly, it may also be the minimum risky (Whilst no investment decision is with out threat). Any investment decision you make could eliminate price and many investments will drop in value at the least Element of time.

Notice that some companies focus on just one fiscal product or service, while some supply a wide range of funding types.

When confined repayment phrases can assist you pay back your debt quicker, it may also be unappealing to borrowers who would basically like much more the perfect time to repay their personal debt, which subsequently presents them scaled-down month-to-month payments to spending plan for.

These are the minimum amount needs at the favored P2P lending System Prosper. While Prosper’s requirements are normal for just a peer-to-peer platform, they may not be the exact same throughout lenders:

Opt for the place to invest. Each platform is different, but most P2P businesses will let you overview the chance profiles and funding requests of various applicants. You may be able to decide to fund some or all of the borrower’s requested loan total in accordance with the investment decision cash you may have obtainable and your ease and comfort degree where risk is anxious.

Develop and fund your account. For those who qualify to invest using a peer-to-peer lending System, your up coming step is to develop an account. From there, you may deposit resources With all the lender so you’re able to evaluate applications from prospective borrowers.

While a FICO credit history rating of 600 (Fair) is definitely the minimal allowable, the organization's personal loan underwriting procedure is programmed to immediately assign the top conditions and rates to applicants with the best credit history score or heritage. The higher your creditworthiness, the greater your personal loan financial investment attract peers.

Discovering how to take a position in real-estate is usually a much larger matter that we could include listed here, but there are methods to get rolling quickly with a modest spending plan.

Variable costs can go up and down determined by various market problems which may result in greater-than-anticipated desire expenditures, significantly in turbulent economic occasions when fascination charges might fluctuate.

Prosper also has fairly free eligibility demands. To qualify for peer-to-peer loans from this lending Market, you’ll should be a minimum of 18 decades aged plus a US citizen or lasting resident.

Peer-to-peer lending operates lots like any other private mortgage. Most borrowers will stick to a Variation of such actions to secure a P2P mortgage:

As a result of this technique, you can find the funding you may need without having to resolve your credit. Having said that, Understand that Upstart’s offer may well not come with essentially the most very affordable check here prices or the most aggressive terms.

We built positive to look at lending marketplaces that appear outside of credit score score when assessing loan programs and managed to discover some of the most effective peer-to-peer lending for bad credit rating.

But In case you have any doubt about irrespective of whether you’re ready to begin investing, make reference to my write-up regarding how to be monetarily disciplined prior to returning to this guideline.

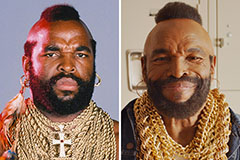

Mr. T Then & Now!

Mr. T Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!